There are certain times that a check will be marked as “FM deposit hold- see SM”. It is important to note that the implication of this is that there is a temporary hold on the check. Most of the time, you could be informed that your deposit is scheduled to go through a stipulated date and there is nothing that the financial institution can do about it.

What does the FM Deposit Hold – See SM mean?

This error message is most likely to reflect in the account statements of individuals that have their checks not going through. It is important for the bank customer to note that this hold on checks is in no way permanent. It is a simple temporary hold on checks that did not go through.

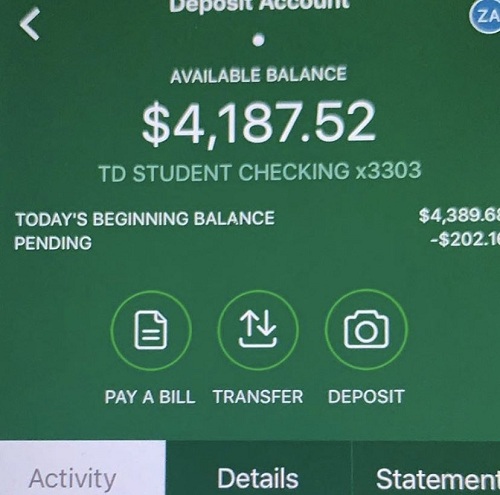

You would most likely be getting this message if you are a TD bank customer. When using the TD Bank mobile app and your check deposit does not go through, you will get a message that message saying FM deposit hold- See SM.

When you go on to visit a TD bank that is nearest to you, they would tell you that the deposit is scheduled to go through on a particular stipulated date and that you can’t do anything about it.

What to do when FM Deposit Hold – See SM Reflects on your Bank Statement

As a TD bank customer, if you find this error message on your bank statement, you should simply talk to the management of the TD bank. In communicating with the bank, you can enquire to see if they can give you any upfronts from the check that you are waiting to go through.

If the TD bank management goes on to grant your request, you will then be given a negative sign on the account balance, and this will be pending when the check goes through. If the check goes through, the TD bank will automatically charge your account to recover the upfront.

How long can TD Bank put a hold deposits?

It is important for a TD bank customer to note that according to the Regulation CC permits banks in America may hold deposited funds for “a reasonable period of time”. What this implies, is that it takes up to two business days for checks that are drawn against an account in a TD bank and then 5 business days for local checks.

What to do to avoid such occurrence in the future?

In order not to have future checks being on hold, you should try not to use weekends as transaction days, or business days. In a bid to mitigate some transaction delays, avoid performing transactions in the weekends by all means. Instead, use your TD Bank to make transactions during weekdays or working days.

Another thing is to bear in mind that checks don’t usually clear as fast as-people think it might. That is why you need to exercise some patience as banks outside electronic systems, do not talk to each other directly.

Picks for you:

How to Order Checks from Bank of America

How to Remove Parent from Chase Bank Account

TD Bank is a terrible Institution. If you are considering opening an account with them, and have other available banking options, choose the other bank.

I have always been in good standing with a checking account and a savings account yet I am constantly dealing with TD Banks poor banking practices. Holding funds from legitimate checks for an excess of 9 days is unacceptable, and that is just the latest headache TD Bank has caused me.

I’ve recently switched to them and am dealing with the same thing among other head aches. I miss J.P. Morgan chase probably going back

Had same issue on a 1,500 check, should of just deposited into Chase instead of TD. May shift back to using only Chase and no longer use TD anymore.

New customer to td bank deposited a check for $1350 and see fm deposit hold check was on deposit date 01/24 I also have account with issuing bank of check and see my check went through on 1/26 so why is this hold still on this and today is 01/31 after I get my money I will be closing this account worst bank ever

How long did it take to clear , I put it in Monday 8pm still pending, sucks

Did you ever receive your 1350 I’m having same problem, I’m a new customer as well deposited a check for 1500 and it’s saying the same for me . I deposited it on Monday 8pm , than the 100 they gave me they took it back

Did you ever receive your 1350 I’m having same problem, I’m a new customer as well deposited a check for 1500 and it’s saying the same for me . I deposited it on Monday 8pm , than the 100 they gave me they took it back

I was told new customers have an automatic hold put on all checks deposited in the first month for 6 business days. The first cheque I put through had a hold put on and I had access to $200 of it before the 6 days. It did indeed go through after 6 days. Subsequent checks also have a hold on them. I’m waiting for two to clear at the moment.