Most of the time, Wells Fargo customers can desire to have some transactions erased from the bank statement. Well if that is why you are here, we got you covered. In the course of this article, we will be looking at a guide on removing a financial transaction from your Wells Fargo bank statement.

About Removing A Transaction From Your Wells Fargo Bank Statement

First off, you need to know that it is not possible to remove a transaction from your Wells Fargo bank statement. Any transaction made on your Wells Fargo bank account is automatically saved to the main internal server of Wells Fargo’s banking mainframe.

According to federal laws in the United States of America, any electronic or monetary transaction in your bank account needs to be documented. This is why it will be available for you to see in hard copy or via online documentation.

How To View Your Wells Fargo Bank Statements Online

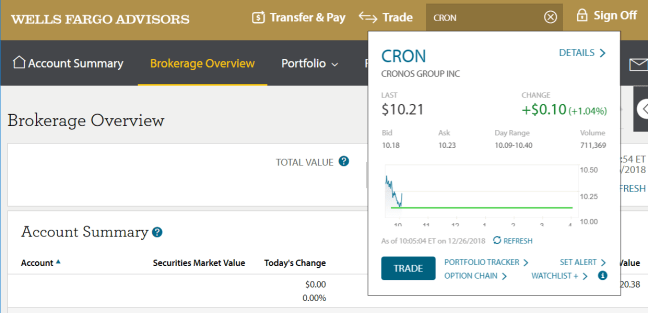

It is important to note that Wells Fargo bank has features that can allow its customers to view their bank statements online. All the Wells Fargo customer needs to do is to enroll to enable this functionality. On the registration page meant for enrolling to receive online bank statements, you will need to key in your social security number, and your date of birth. Also worth noting is that you can use your Wells Fargo bank app to view your bank statements and entire transaction history.

All the customer needs to do is to sign on to view the account activity, then select the Wells Fargo account for viewing activity. Next, you will see three vertical dots next to your Wells Fargo available balance. Other than the bank app, an ATM can be used to view your Wells Fargo bank statement. However, in this case, what you will see is a condensed version of your bank statement that details only your last 5 financial transactions.

The Advantages Of Using Your Wells Fargo Bank Statements

With the aid of a Wells Fargo bank statement, and the ability to view your transactions, there are lots of things a customer can accomplish. Here are some of the advantages:

- You can easily and quickly access past bank transactions, no matter how old they are

- A Wells Fargo customer can reduce the risk of fraud and identity that comes with Wells Fargo paper statements.

- With an online statement, a customer can reduce clutter by printing only what is needed.

- With an online account, you will get email notifications as soon as your Wells Fargo bank statements are ready.

Conclusion

It is always a good idea to have an accessible Wells Fargo bank statement. This is because you can track your transactions and find ways to save in fees, especially if you pay excesses for savings transaction fees. You and your financial institutions are the only parties that have access to your bank statements on your Wells Fargo bank account.