To close your Merrill Edge account, you need to follow a few steps based on the account type and the reason for closure. This guide will walk you through the process of closing your Merrill Edge account.

However, before you start, it’s essential to understand that closing your Merrill Edge account may attract fees or tax consequences. Additionally, you must liquidate any open positions in your account before closing it.

7 Steps To Close Your Merrill Edge Account

Step 1: Log In to Your Merrill Edge Account

The first step to close your Merrill Edge account is to log in to your account on the Merrill Edge website. Once you’re logged in, go to the “Accounts” tab and select the “Transfer & Withdraw” page.

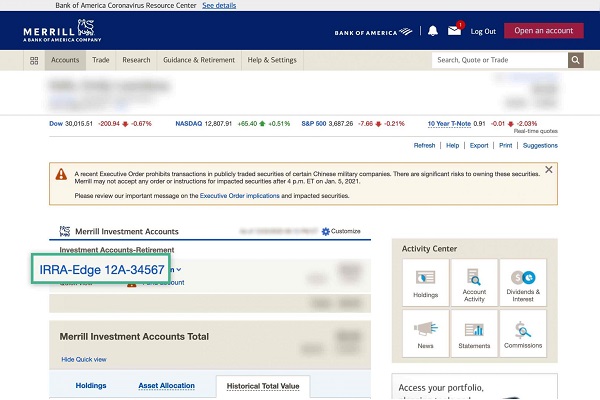

Step 2: Choose the Account You Want to Close

Next, choose the account you wish to close. If you have multiple accounts with Merrill Edge, ensure you choose the correct account that you want to close.

Step 3: Request to Close the Account

After selecting the account, submit a request to close the account. You can do this by clicking on the “Close Account” button and following the prompts.

Step 4: Verify Your Identity

As a security measure, Merrill Edge may ask you to verify your identity before closing your account. You may need to provide your social security number or account number.

Step 5: Liquidate Your Account

You need to liquidate any open positions in your account by selling any securities, including stocks and bonds.

Step 6: Review Your Account Balance

Once you’ve liquidated your account, review your account balance to ensure that all assets have been sold, and any remaining cash has been withdrawn.

Step 7: Confirm Account Closure

Finally, verify that your account has been closed by checking your account status on the Merrill Edge website. If your account is still active, contact Merrill Edge customer service for help.

Pros And Cons Of Having A Merrill Edge Account

Merrill Edge is an online brokerage service with its own set of advantages and disadvantages. Here are some of the pros and cons of using a Merrill Edge account:

Pros:

- Low Fees: Merrill Edge’s fee structure is relatively low compared to other online brokerages. They do not charge annual account fees, inactivity fees, or maintenance fees.

- Accessibility: You can easily manage your investments through Merrill Edge’s website or mobile app, which means that you can access your account and make trades from anywhere.

- Research and Analysis Tools: Merrill Edge offers various research and analysis tools to assist you in making informed investment decisions. These tools include stock research reports, market data, and portfolio analysis tools.

- Integration with Bank of America: If you have a Bank of America account, you can link it to your Merrill Edge account, enabling seamless transfers between accounts.

- Educational Resources: Merrill Edge provides educational resources such as webinars, articles, and video tutorials that are helpful for beginners to understand investing.

Cons:

- Limited Investment Options: Merrill Edge does not provide access to some investment types, such as options trading, futures trading, or cryptocurrency trading.

- High Commissions for Some Trades: Although Merrill Edge does not charge annual fees, their commission fees for certain trades can be high compared to other online brokerages.

- No Fractional Shares: Unlike some other investment platforms, Merrill Edge does not offer the ability to purchase fractional shares, which can make it challenging to invest small amounts of money.

- Limited Customer Support: Merrill Edge’s customer support is available during specific hours only, which can be inconvenient if you require assistance outside of those hours.

- Minimum Balance Requirement: To open a Merrill Edge account, you need to have a minimum balance of $0, but to be eligible for certain benefits such as free trades, you need to maintain a specific minimum balance in your account.

Conclusion

In summary, closing a Merrill Edge account is a simple process that can be completed online. However, keep in mind that you may incur fees or tax consequences when closing your account, and you must liquidate any open positions before closing it. If you have any concerns or questions about closing your Merrill Edge account, don’t hesitate to contact customer service for assistance.