Most beginners option traders have one thing in common; they like to cut costs. If you are an option trader, looking for a broker to diversify your income portfolio and still cut costs in the process, then Robinhood is the sure pick. This article focuses on a hands-on review of option trading on Robinhood for absolute beginners. Without further ado, let us delve in.

What The Robinhood Broker is All About

Robinhood Broker is an option trading platform that offers users a mobile solution for investing in stocks, ETFs, options, fractional shares and cryptocurrencies. However, if you are an option trader looking for an IRA account or wanting to buy mutual funds, you will have to look elsewhere.

The Robinhood platform offers zero dollar commissions, a high quality mobile investment app, and crypto investment options.

In the past, investment was like a monopoly that only the wealthy could afford. However, in 2013, Vladimir Tenev, and Baiju Bhatt democratized investing by creating the Robinhood broker. This platform has given thousands of beginner and expert option traders access to the financial markets.

Top Perks Of Robinhood That Makes It A Good Choice For Beginner Option Traders

There are a few interesting perks that make the Robinhood broker a must-pick for beginner options traders:

1. Their Affordable Commissions

One of the reasons why the Robinhood platform is good for beginners is that it has a no-commission approach to trading. Interestingly, they charge $0 for stock, ETFs, cryptocurrency, and option-based trades on their mobile app or website.

In the option trading industry, it is rare to see platforms that offer zero-dollar commissions. Most do charge a small fee on a per-contract basis, but the Robinhood platform allows option traders to buy and sell with no commissions at all. This is why it is a good pick for beginners in option traders. Most beginners like to experiment, and with no commissions per contract, they can curb losses with ease.

2. They Offer Seven Cryptocurrencies On Their Platform

Another interesting perk of the Robinhood Option trading broker is that they offer seven cryptocurrencies. Although this is not a huge range, it allows beginners to lay hands on the market or limit orders with zero dollar commissions.

Worth noting is that the crypto-security features of the Robinhood platform are in line with other major cryptocurrency exchanges.

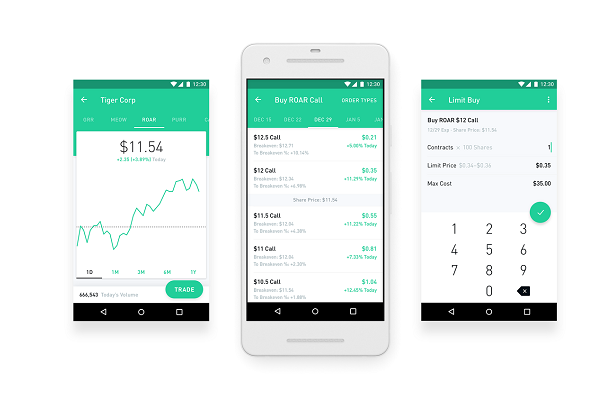

3. The Simplicity Of Their Trading Platform

Nothing is more eye-catching to beginners option trade investors than the simplicity of the platform they are using. One of the greatest vantage points of the Robinhood option trading platform is that it has a simple design across its web and app versions. A beginner trader would definitely find the app and web version easy to navigate and use.

4. Enticing Margin Rates

If you are using the Gold premium version of the broker, you will get the ability to invest at a margin rate (borrowed money). The Gold Premium version costs $5. This is good for beginner option traders that want to get their hands dirty with some affordable risk trading.

With their margin rates package, the first $1000 of margin balances are absolutely free. This implies that the trader would not pay interest on margin trades that are small. Although the major downside is that an option trader would need a minimum of $2000 to be able to use the margin trading feature. Also worth noting is that the margin rate for Robinhood is 2.5%.

5. Extensive Research Offerings

Another key takeaway from Robinhood platform is that it offers extensive research functionality to Premium Gold members. They offer reports from other marketing firms such as Morningstar. They do offer stock market research, with the downside being that they do not offer cryptocurrency market research with their research functionality.

The research functionality of the Robinhood platform is good for beginners because newbies in the option trading industry need to be guided most of the time.

How to Enable Option Trading on Robinhood

If you are a newbie to option trading, you might be wondering how to use the Robinhood platform. First off, it is important to note that all you need to start investing is a valid social security number.

Go to the playstore or apple store and download the app. Then follow the prompts you see in the app to register an account with the Robinhood broker. The next big step would be to make some deposit in the Robinhood app, then you can start investing.

When you click on a stock that is listed, it allows you to see its price history, other interesting details about it, and the buy and sell option. If you want to make automated investments, then you can enable push notifications. This way you will get necessary notifications on your watch-list of stocks. According to the information you want to see, you can customize your notifications in the settings of the Robinhood app.

For newbies in option trading, the best way to make use of the Robinhood platform is by investing a small amount of money that you are comfortable with losing. They have tools that can allow you to do some research. This means that before you buy any stocks or ETFs, you should look into them first.

The key takeaway functionality of the app for newbies, is that the Robinhood app has a stock market simulator. The simulator on the Robinhood app allows users to create a “practice portfolio” which will help you to learn how the market fluctuates with time.