APY also known as “Atal Pension Yojana” is a social security scheme that gives pension offers to persons working in an unorganized sector. This scheme allows beneficiaries to make monthly contributions that would secure their post-retirement phase of life. As an existing beneficiary, it is possible to request for online withdrawal.

This article includes a detailed exit guide to the APY scheme. Without further mouthing, let us cut to the chase.

What Is The Atal Pension Yojana Scheme?

The Atal Pension Yojana scheme is a pension scheme that was orchestrated by the Government of India. It helps Indian beneficiaries to pay a cash amount to the pension account in a bid to fund their retirement when they reach 60 years of age.

The main perk of the pension scheme is to provide beneficiaries with assured returns. It is important to note that this scheme was launched in India way back in 2015. The operations of the APY is managed by the Pension Fund Regulatory and Development Authority (PDRDA).

In this pension scheme, all Indian unorganized sector workers can save money for their post-retirement life on a voluntary basis. If an Indian falls between the ages of 18 and 40, they can opt for the APY scheme.

How To Withdraw From Atal Pension Yojana Account (APY)

There is not much fuss about the online withdrawal procedure in APY. Here are the simple steps involved in exiting APY online:

- First off, you have to head to the bank where you have your Atal Pension Yojana account.

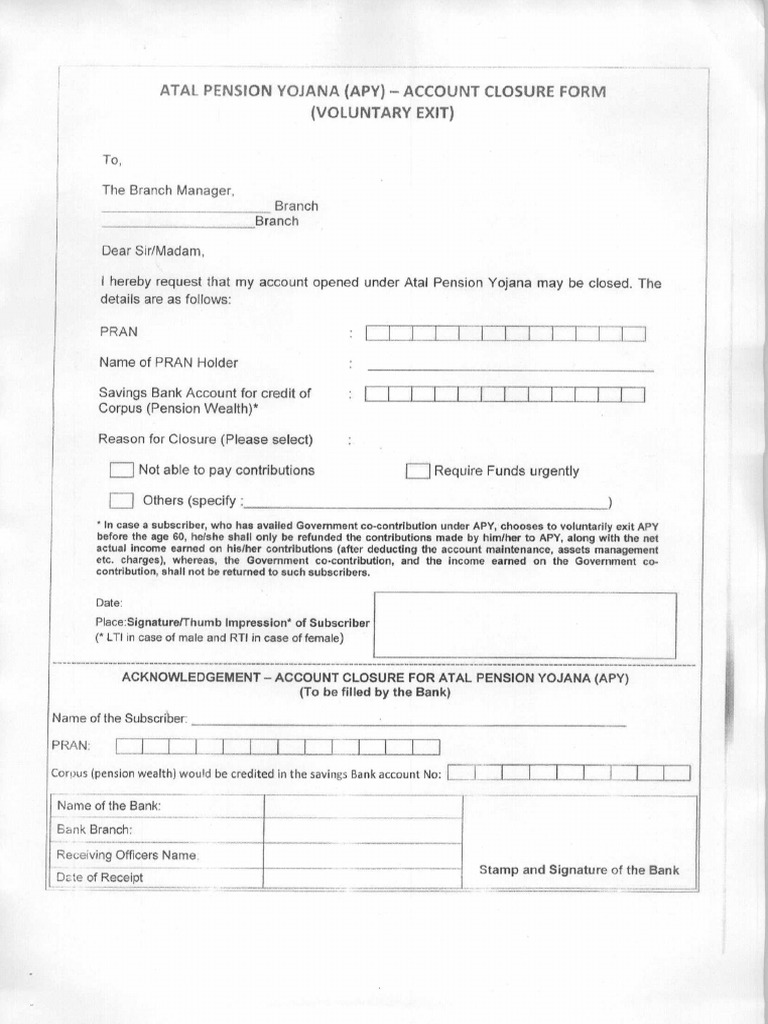

- Then fill out the Atal Pension Yojana cancelation form with the required correct details.

- After filling it, you then have to sign it and wait for the verification of your withdrawal application. It is important to note that the APY withdrawal form can also be downloaded online from the website:

- When the process is complete, the amount and interest will then be credited to your linked financial institution. The beneficiary would also receive a notification from the bank on their mobile number that is linked with the APY account.

- Finally, you will be offered an acknowledgment receipt from the bank that processed your APY withdrawal.

- You can also check APY Withdrawal status here.

Documents Required For The Closing Of An APY Account On A Conditional Basis

It is important to note that if a beneficiary of the APY scheme dies before the age of 60, the family members would require some important documents. These documents would be used to process the premature withdrawal:

- The original death certificate of the APY beneficiary

- The bank details of the family members or nominee

- A certificate that proves the relationship with the APY beneficiary; legal heir certificate or certificate issued by the Executive Magistrate.

Illnesses That Can Qualify A Person For APY Withdrawal

It is important to note that under the National Pension System Regulations 2015, there are illnesses that can qualify a beneficiary to exit the APY scheme. However, keeping an eye on the list of illnesses is necessary as the Pension Fund Regulatory and Development Authority updates it from time to time.

You should not opt-out of the APY scheme unless there is an emergency. If you want to take an informed decision about the APY, make consultations with a financial advisor.

Here is a list of illnesses that make you eligible to exit the APY scheme:

- Kidney failure

- Stroke

- Organ transplant

- Myocardial infarction

- Coronary artery bypass

- Paralysis

- Coma

- Blindness

- An accident that was life-threatening

- Primary pulmonary arterial hypertension

- Cancer

- Aorta graft surgery

- Multiple sclerosis

Types Of APY Exit

Now that you are well versed with a guide on how to exit the APY scheme, there are three types of APY exit:

- Exiting due to the death of the beneficiary

When a beneficiary of the APY scheme dies, it implies before the age of 60 years, there are two options available; the APY account would be closed, or the account would be continued by family members and next of kin.

- Voluntary Exit From The Scheme

Another interesting way to leave the APY scheme is by leaving it of your own volition. It is important to note that in this case, the Indian Government would online refund the accumulated contributions and interest that you earned over the years.

- Exiting The APY Due To Illness

As is elucidated above, a person can leave the APY due to specified illnesses. The Indian Government in this case would refund the accumulated pension corpus to your bank account.