Your chase bank statement is documentation that shows the financial transaction you made within a particular time frame. For instance, a typical chase bank statement shows the customers their deposits and withdrawals for a particular month.

It is with the aid of a chase bank statement that you can see errors in your account. Or even check for suspicious activity. Most of the time if you want to apply for a loan or a mortgage, you would need a bank statement, whether in an online or offline format.

Most of the time, certain chase customers do not want to see some of the transactions that are on their chase accounts such as deposits to online casinos or other less-financially responsible transactions. This has brought about the queries that are now trending in most chase online communities: “how to remove a transaction from chase bank statement”.

What would a chase customer usually see on a bank statement?

A chase account holder might see the same bank statement report if they have both a checking and savings account in the chase bank. Here is a list of things that a chase customer would likely see in their bank statement report:

- The account number of the chase account owner

- The home address of the account owner

- The statement period

- The Chase customer service number

- The beginning balance for the time period

- How the chase customer can report fraudulent activity

- The check deposits

- The direct deposits made in the chase account

- The canceled checks or payments

- The credits or reimbursements

- The payments or purchases withdrawals

- Electronic transfers of the chase account holder

- Auto payments

- Fees that are charged by chase

- Dividends that are earned by the customer

- Interests that are earned by the customer

- Ending balance for a particular time frame.

Is it possible to hide a transaction on your chase account?

If a chase customer wants to hide some particular transaction, all they need to do is head to the “edit details” option that is over the transaction. Then go ahead to check the box that says “this is a duplicate.” This way they can delete the duplicate transaction or other transactions that they don’t want seen.

Is it possible for a chase customer to hide transactions that pertain to online banking?

Truth is, it is impossible to hide chase transactions that are done with online banking. It would reflect in your chase account permanently. The only out is if the chase customer should take a statement of your account after the date of the transaction. This way, the transaction may not reflect. Not reflecting does not mean that is removable or hideable.

What really happens when a chase customer hides an account?

The only way this can be done is by closing a chase account. After closing your online chase account, then all your online credit card accounts would be hidden.

The closed account would continue to be in your online profile for several months even though you have not performed any financial activity on it.

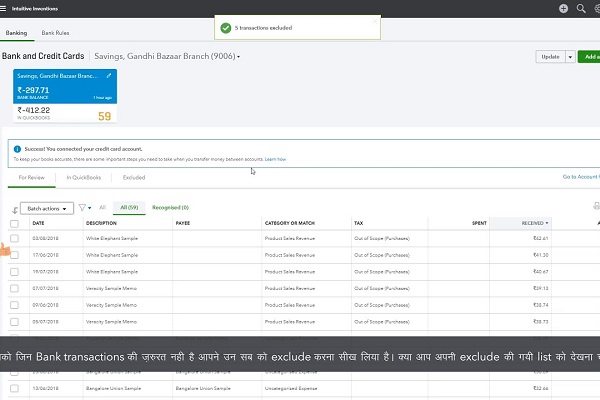

Practical guide on how to delete transactions from your bank statement chase

It is possible for a chase customer to delete transactions from a bank feed or a manual statement upload. All the chase account user needs to do is to click on the name of the transaction that they want to delete. Then select the option labeled “More options”. Just select “delete this transaction” in order to complete this transaction deletion process.

It is important for the chase customer to bear in mind that if a transaction has been deleted from the bank statement that it cannot be recovered.

Picks for you:

How to transfer money from Chase Credit card to bank Account

How to Activate Bank of America Debit Card