Here is our comprehensive guide on How to Open an account with Citibank. Citibank is a leader in personal banking, credit cards, and wealth management. Did you know that the financial institution known as Citibank has been around for more than 200 years?

Whether you are a first-time bank account owner or you want to enjoy an experience across multiple, learning how to open a Citibank account in a practical way is as simple as spending a few minutes on this Geniuzmedia article.

How to Open an Account with Citibank in 3 steps

As a wanna-be Citibank customer, you might be asking yourself, what do I need in a bid to open a Citibank account? Well, the requirements of opening a Citibank account practically depends on your banking needs. The account you want to open, would be hinged on whether you want a bill-pay account, account for paying utilities other inter-personal monthly expenses.

Here are the three practical ways for you to open a Citibank account;

1. Put Together the required personal information

If you are applying for a Citibank account in person or online, the following are the important details that would be required of you.

- Your personal information, such as your name and date of birth

- Social security number of the applicant

- The contact information of the applicant, which would very much include; the email address and phone number.

- The income and employment status of the Citibank wanna-be customer.

- If however you decide to go one of the branches of Citibank, you would be required to have your driver’s license, military ID or state ID with you in other to verify your identity.

2. Select the Citibank Account Type That you wish to open

Check out Citibank’s account options to determine which one is the best fit for you. The Citibank accounts are created for customers based on your account balances. There aren’t any minimum balance requirements, however there is a month-long fee for maintenance fee is charged when you fail to keep the required minimum balance.

Citibank Checking Accounts Options and What they look Like

- Citigold Account option: The account is free of charge. There aren’t any annual fee for maintaining the account.However, you’ll have to keep at least a $200,000 balance per month at or greater across your eligible Citi accounts. It would not be wrong to assert that this account type is sometimes regarded as a high-end checking account. .

- Citi Priority Checking account option: Citi Priority checking comes with the same interest-earning, low-cost features like the Citigold account. However, it important to note that it has lower minimum balance requirement. If you don’t have a total account with a balance greater than $50,000 you’ll have to be charged a monthly maintenance fee.

- The Citibank Account: If you are the type of customer that can maintain an average balance of at least $10,000 there will be the option of paying a monthly maintenance fee.

- Basic Banking option with Citibank: this account type is most ideal for those who want to get basic banking, and avoiding having to pay a monthly fee which is just $12 easy. Keep a balance of at least $1500 and plan one bill pay, or receive at minimum one direct deposit every statement cycle. Furthermore, people over the age of 62 are eligible for a free Basic Banking.

- Access Account option with the citibank: This is a checking account option that is best suited for those who are digital bankers. It is important to note that you would be able to save the $10 per month fee in the same manner as basic banking. You’ll need to maintain at least $1,500 in balance and plan one payment per bill or make at minimum one direct deposit each statement cycle. The primary distinction among the Access and the Basic account is the check. Check-writing privileges are not available when you have access accounts. Access account.

Citibank Savings Accounts Option for Wanna-be customers

- Citi Savings Option: Rates of interest here are contingent on the account option that you opt for, as well as on the checking account you are opening in conjunction with it.

3. Go ahead To Apply To Open a Citibank Account

It is possible to apply to open an account online or over the phone , or even in person. The process is simple provided you have the necessary information mentioned above.

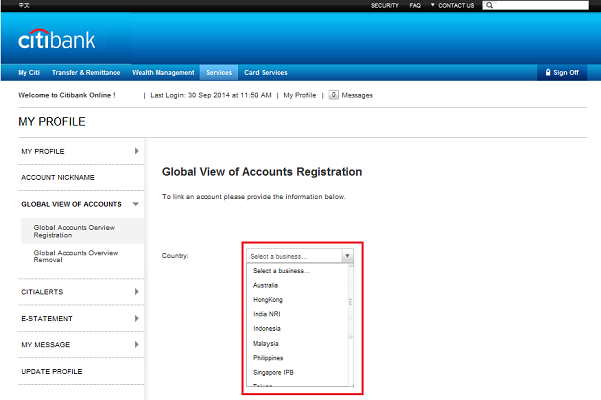

To Apply online, follow the below Elucidated steps:

- Visit this page to access the Citibank website.

- Select “Open an account” on the menu bar at the top towards the right.

- Choose the account you wish to create.

- Please fill in the information required.

For applications in person:

You may also go to the nearest Citibank branch and let an agent guide through the process of applying. It is a good option for those who are brand new to Citibank or who are not familiar with banking generally. To locate an Citibank branch close to you, go to its Branch locator and input your location.

Picks By Editor:

How to Unfreeze Chase Bank Account

How to use Zelle With Bank of America | Step by Step Guide