The chase debit can also be used to make international money transfers from your account. When it comes to online money transfer services, as a chase bank customer, the chase debit card is your go-to card. In the course of this article, we would be learning how to add Money to your chase account with your debit card.

Practical Steps to Transfer Funds into Your Chase account with your debit card

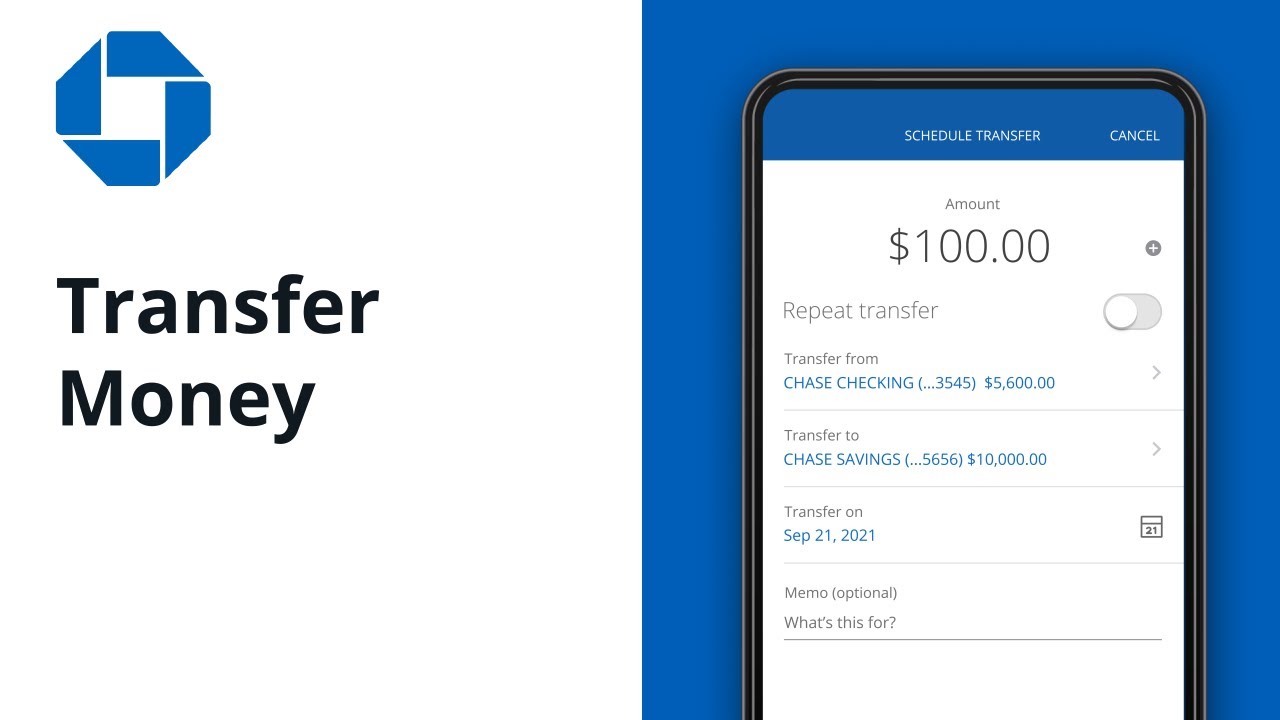

Transferring money into your Chase account involves moving money from either your checking to your savings or from your savings to your chase savings account. All the same, here is how to use an ATM and your debit card to transfer money into either your chase savings or checking account;

- Get your chase debit card and enter your PIN

- Select the “main menu” option and then “More”

- Go ahead to select the “Transfer” Option on the ATM or POS machine

- Then select the chase accounts that you want to move the money to and from.

- Proceed to type in the amount of money that you wish to transfer

- Then Tap the complete option in order to complete the fund addition procedure.

Pros and pros of debit cards to transfer money to your chase bank account

Debit cards function similarly to credit cards, but they are linked to your checking account or bank account. If you purchase or make transactions using your debit card the funds are immediately debited out of the Chase bank account. A credit card on the other hand allows the chase bank customer to take out loans up to a specific limit. Here are the pros and cons of using a debit card to transfer money to your chase account:

Pros of using a chase debit card

- There are no annual charges

- They are great for emergencies transfer directly from an account at the chase bank account

- You could qualify to earn rewards if you use the debit card in conjunction with your chase bank

- They are a popular payment method that often offers immediate transfer

Cons of using a chase debit card

- Debit cards typically have greater international transfer charges than other alternatives.

- You can only use your Chase savings and checking accounts with your chase debit card.

- There is an issue of less flexibility since most companies do not accept credit cards because they want to have an avenue for billing you for damages that might come to their property if possible.

- If you card is to stolen within two business days, you need to report it stolen or else you might be incur fraudulent charges on your debit card.